Why Consider P2P Crypto Exchange Development in 2025: The $320 Million Wake-Up Call In CeFI Industry

In 2024, the crypto market experienced significant volatility, with security breaches further shaking user confidence in centralized exchanges. The $320 million hack of the Japanese centralized crypto exchange DMM Bitcoin due to insufficient security measures highlighted the ongoing risks of custodial platforms. This came after FTX’s catastrophic $8.8 billion loss of customer funds in 2022, which undermined trust in centralized finance (CeFi).

In contrast, P2P crypto exchanges are a more secure and transparent alternative, allowing businesses to rapidly gain user trust and expand market share. Recent trends confirm the increasing impact of decentralized trading solutions:

- 25% decrease in losses due to hacks (Immunefi report, 2024)

- a potential increase in active users up to 53.56 million in 2025 according to Statista (compared to 18.9 million in 2024)

This guide shows business leaders how to capitalize on this market transformation, breaking down:

- Development costs and timelines

- Revenue generation models

- Security strategies

- Scaling frameworks

Whether you’re a startup founder or an established business, you’ll learn how to evaluate, build, and launch a P2P exchange platform.

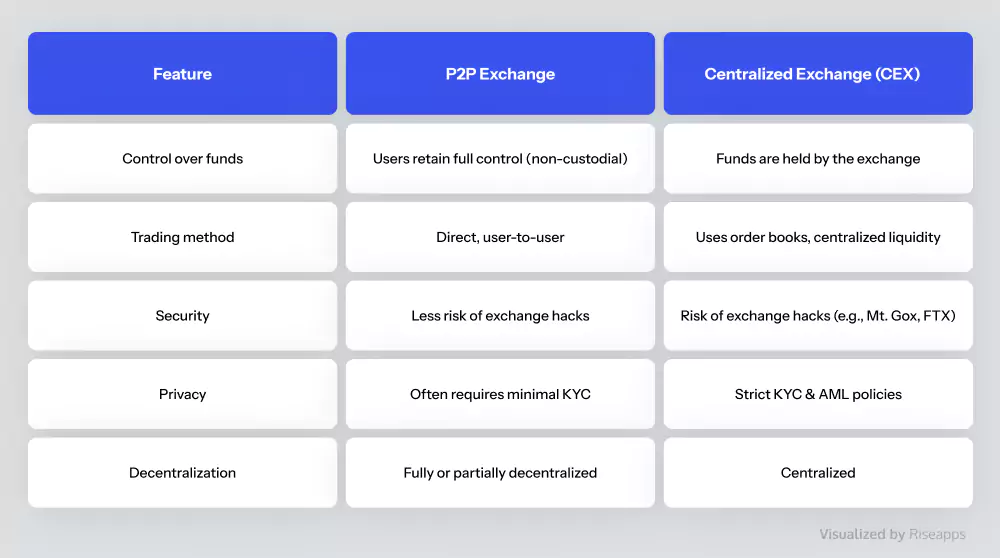

Key differences between P2P and centralized exchanges (CEX)

A peer-to-peer crypto exchange allows users to trade cryptocurrencies directly with each other without intermediaries like centralized exchanges (CEXs). For instance, such open-source P2P solutions as Bisq offer simple exchange services even without registration and identity verification but with a guided user experience flow to help traders quickly and stress-free complete transactions. To ensure fair and secure transactions, P2P services use escrow systems, smart contracts, and atomic swaps.

CEXs on the contrary provide trading services governed by a central authority, responsible for matching orders and ensuring transaction safety. Such cross-platform solutions as Kraken conduct secure crypto or fiat exchanges for users, simplifying the process and holding user crypto assets to protect them.

Here’s how both approaches compare according to different criteria:

P2P crypto exchange platforms are complex solutions that require specialized expertise in blockchain development and cryptography. The degree of decentralization also impacts the overall project complexity. A higher level of decentralization requires more nodes to maintain the network which, in turn, needs increased computational and storage capacity. Therefore, to develop a decentralized blockchain-based P2P solution, a skilled team is a must.

P2P exchange market entry: revenue models and success metrics

Despite the technical complexities, businesses investing in P2P exchange development can access a rapidly growing DeFi market, estimated to reach $376.9m by 2025 according to Statista. Businesses can capitalize on increasing user demand and generate revenue through:

Transaction fees

With an average industry-standard fee of 0.2%–1.5% per transaction, and an anticipated revenue per user of $50 in 2025 (estimated and rounded number according to Statista), your monthly revenue per 1,000 active users can range between $50,000 and $75,000, depending on trading volume.

Premium services

For instance, you can charge $50 per user per month for premium features. And If 15% to 20% of users opt for premium services, this can significantly boost monthly income (range between $7,500/month and $10,000/month.

Payment gateway fees

Implementing a 1% to 2% fee on payment processing can equate to an additional $5 to $10 per transaction.

Market entry costs: Investing in a P2P exchange

Entering the P2P crypto exchange market requires strategic financial planning. Businesses can choose between white-label solutions for a faster, cost-effective launch or custom-built platforms for greater control and scalability.

Development costs

A white-label crypto trading solution like RiseChain can be launched for $50,000+, providing a ready-to-deploy platform with essential trading features. In contrast, a fully custom-built exchange may require a $1 million+ investment, covering development, security, and infrastructure.

Marketing expenses

A minimum of $100,000 is recommended for the first six months, covering brand positioning, paid ads, and user acquisition campaigns to attract a critical mass of traders.

Operational costs

Running the exchange, including server maintenance, customer support, compliance, and liquidity management, can cost around $20,000 per month.

With 1,000 to 2,000 active users, a P2P exchange can break even within 6 to 12 months, depending on trading volume, transaction fees, and premium service adoption.

Learning from the best: Global P2P crypto exchanges that win the hearts of their users

The most successful P2P platforms have captured significant market share by offering unique value propositions tailored to their target audiences:

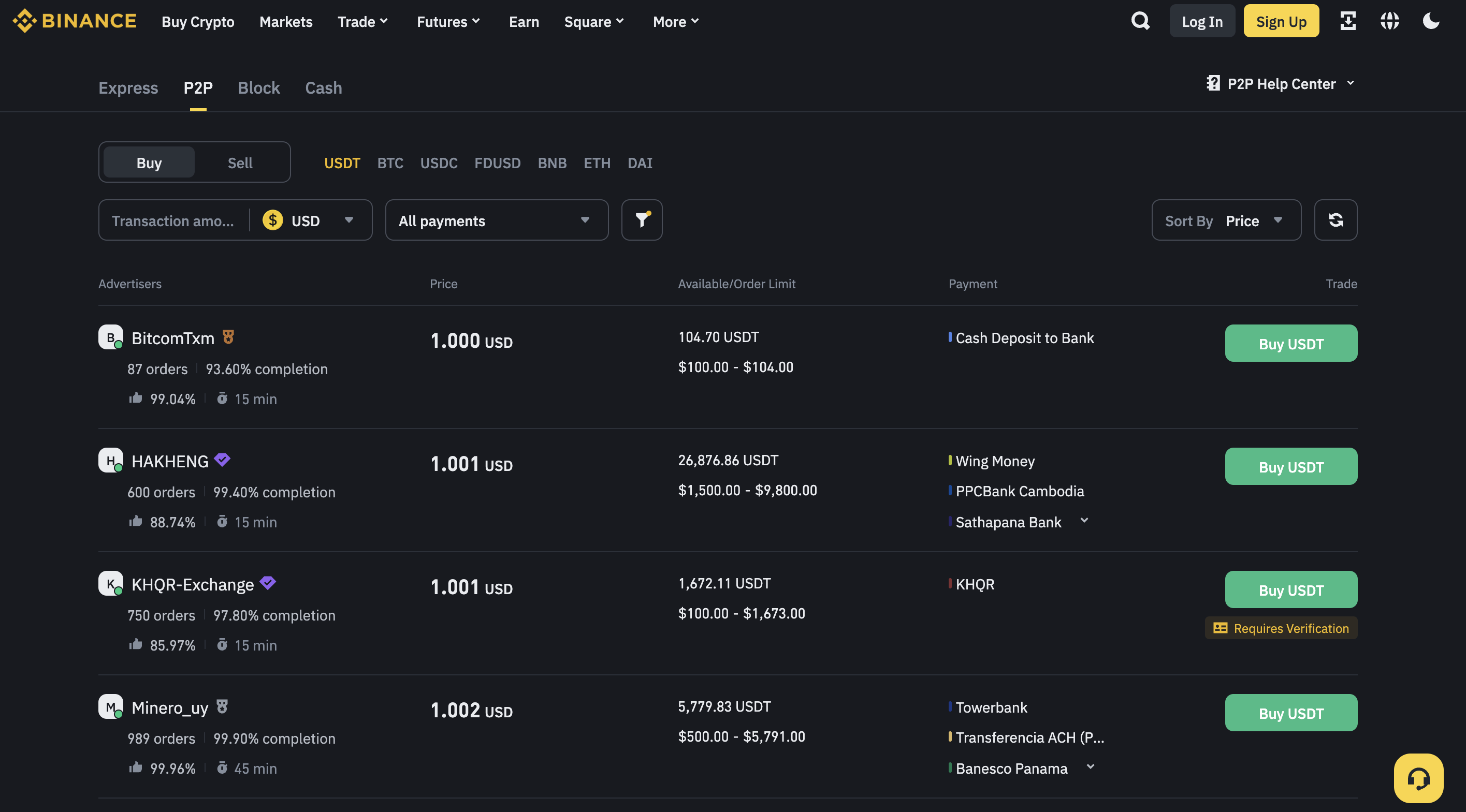

Binance P2P

With daily trading volume reaching $54 million, 150 payment channels around the world, and 3.8 billion orders a year, Binance P2P solution turned out as a revenue-generating investment. The company leveraged their existing CEX user base, ensuring instant liquidity and trust. Key lesson: Integrating P2P trading within an established ecosystem reduces adoption barriers.

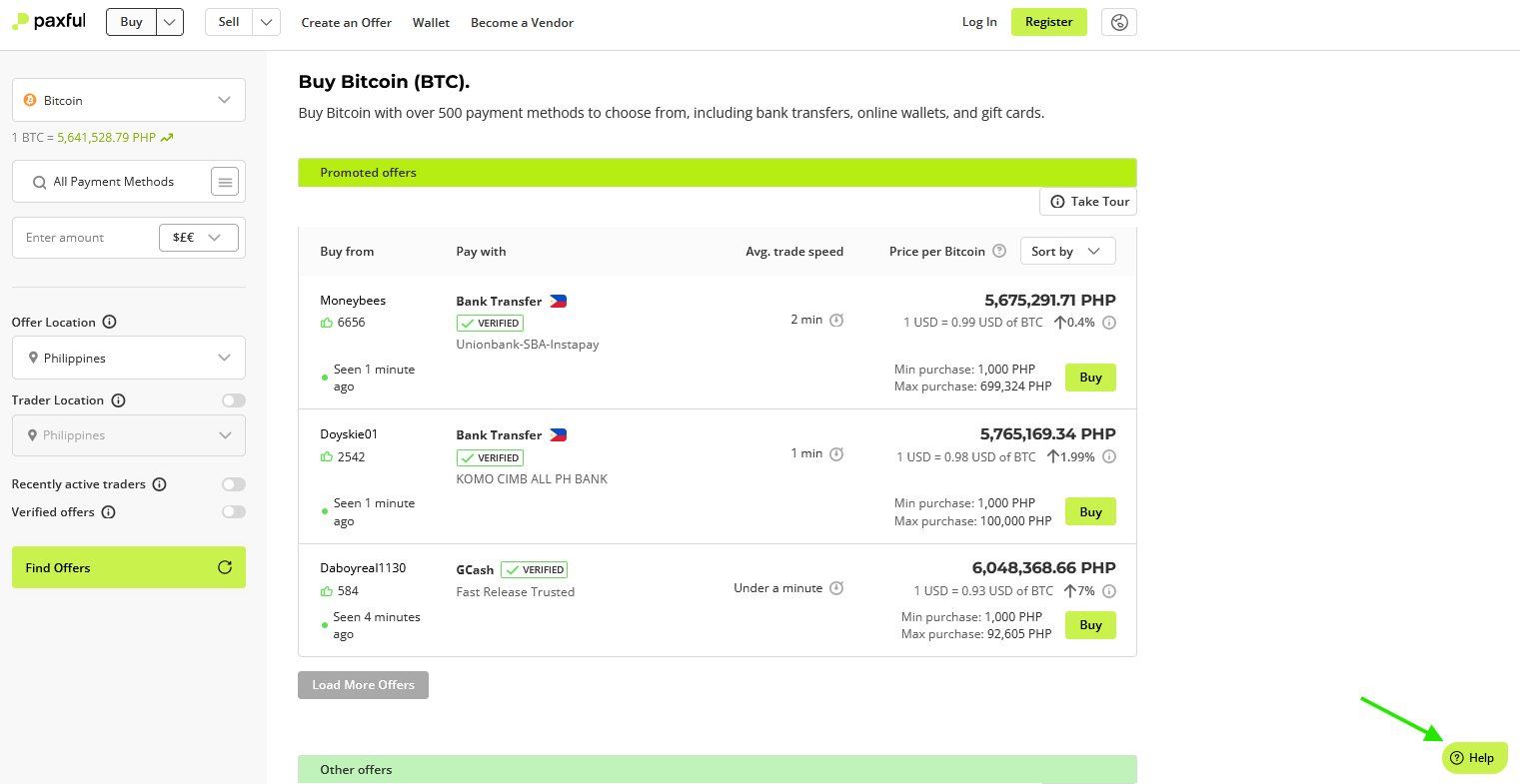

Paxful

With more than 14 million increase in users and transaction volume, Paxful is focused on financial inclusion by supporting over 350 payment methods across 170+ countries. Key lesson: Offering diverse payment options increases accessibility, especially in underbanked regions.

Build vs buy: ROI analysis of P2P exchange development options

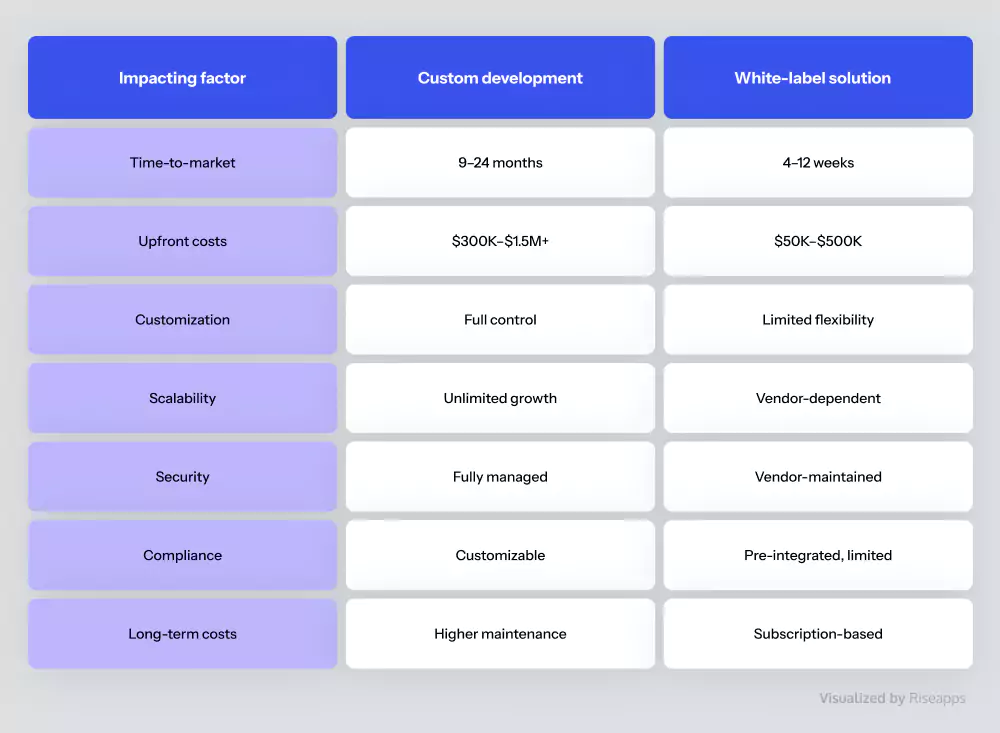

The decision between custom-built and white-label P2P crypto exchange depends on factors like development cost, time-to-market, scalability, compliance, and long-term maintainability. Below is a detailed, technical breakdown of both options.

Custom P2P crypto exchange development

A ground-up approach ensures full control over architecture, security, and feature set, but comes with higher resource demands and a longer development cycle.

Advantages

Full code ownership and security

A custom-built exchange allows complete control over the source code, infrastructure, and security policies. This eliminates reliance on third-party vendors and enhances data sovereignty. For enterprises handling high-volume transactions, this is critical for regulatory compliance and risk mitigation.

High-performance scalability

A well-architected system ensures seamless scalability as the user base grows.

Custom integrations

Custom solutions allow integration with proprietary KYC/AML modules, AI-driven fraud detection, and market-making algorithms. Companies with unique liquidity needs or institutional clients can develop specialized matching engines, liquidity aggregation, or even non-custodial trading options.

Regulatory compliance control

Unlike off-the-shelf solutions, custom development ensures full regulatory alignment, such as GDPR (Europe), MAS (Singapore), or SEC regulations (U.S.). This is crucial for enterprises entering regulated markets where compliance failure can lead to multi-million-dollar fines.

Challenges

High initial investment

For a custom P2P exchange, you’ll need approximately $300K–$1.5M+, depending on complexity, security architecture, and liquidity management. Additional costs include:

- Security audits: $50K–$200K per audit (penetration testing, smart contract verification).

- Infrastructure: High-performance servers, DDoS protection, and global CDN integration (~$50K+/year).

Time-to-market delay

P2P crypto exchange development from scratch can take 9–24 months, factoring in:

- Backend architecture (~4–8 months).

- UI/UX and trading engine (~3–6 months).

- Security testing and compliance (~3–5 months).

Specialized expertise required

To develop a successful customized P2P exchange solution, you’ll need senior blockchain engineers, cryptography experts, compliance officers, and security auditors. Finding and retaining a highly specialized team can increase operational costs by 20–30% annually.

White-label P2P crypto exchange development

A white-label P2P exchange is a pre-built, customizable solution that accelerates deployment and reduces upfront investment. It’s the right fit for businesses that prioritize speed and cost-efficiency over deep customization and brand identity.

Advantages

Rapid time-to-market

A white-label solution enables businesses to launch in 4–12 weeks, making it ideal for fast market entry.

Lower cost

White-label exchanges typically cost between $50K–$500K, depending on the vendor, feature set, and customization needs. Some vendors even offer subscription-based licensing, reducing upfront capital investments.

Built-in liquidity and security

Many vendors provide pre-integrated liquidity pools, reducing the risk of low trading activity at launch. Established solutions also come with DDoS protection, multi-signature wallets, and KYC/AML integrations, reducing security risks.

Vendor support and maintenance

Businesses avoid ongoing technical upkeep, as providers handle system updates, bug fixes, and compliance updates. This reduces DevOps costs and internal security risks.

Challenges

Limited customization

Most white-label solutions restrict modifications to their trading algorithms, liquidity models, and UI/UX frameworks.

Dependency on vendors

When releasing security patches, new features, or regulatory updates, business highly depends on the provider’s timeline. And if a vendor fails to perform them on time, businesses may face compliance risks or downtime issues.

Vendor lock-in risks

Transitioning to a different provider or migrating to custom-built infrastructure later can be costly and time-consuming, as most vendors retain control over the core codebase.

Which path is right for your business?

Use the below comparative table to decide on the trade-offs you’re willing to make before starting the P2P crypto exchange development process.

Ground-up development overview: 3 phases of P2P crypto exchange development

From this section, our article takes a more practical turn, as we focus on P2P exchange development steps, features, security measures, and how Riseapps experts can be of help.

Phase 1: Laying the foundation (MVP development – 3 to 6 months)

Understanding the core architecture

Before developers write a single line of code, a software architect defines the P2P exchange’s architecture. A P2P crypto exchange architecture consists of multiple layers:

- Frontend (user-friendly interface). It is the first thing users see when they open an exchange solution and where they directly interact with the platform to list trades, start transactions, and communicate with other traders.

- Backend (core software logic and security). This architecture layer takes place trade matching, escrow services, payment verifications, and dispute resolution. The backend layer defines how efficiently your trading platform will work and requires highly skilled expertise.

- Blockchain integration layer. This layer records transactions on-chain, supporting multiple blockchains like Bitcoin, Ethereum, and Solana.

- Payment integration layer. Here the platform facilitates fiat on/off-ramps and crypto payments, enabling users to fund their accounts through bank transfers, credit cards, stablecoins, or local payment methods. This layer ensures currency conversion, compliance with financial regulations, and seamless transactions.

- Security and identity management. At this point, the architecture handles authentication, KYC verification, AML monitoring, and fraud detection to prevent illicit activities.

Choosing the right technology stack

To develop a successful P2P exchange, your development team requires a tech stack that balances performance, security, and decentralization.

- Frontend development: React.js or Next.js for web applications, Flutter or React Native for cross-platform mobile apps.

- Backend development: Node.js, Golang, or Python (FastAPI, Django) for scalable APIs.

- Database and real-time processing: PostgreSQL or MongoDB for structured data, Redis for caching, and WebSockets for real-time trade updates.

- Blockchain interaction: Web3.js, Ethers.js for Ethereum-based transactions, and BitcoinJS for BTC integration.

- Security: OAuth 2.0, JWT for authentication, AES-256 encryption for data protection.

Building the core MVP features

Once you have a clear understanding of the architecture design and technical stack, begin P2P crypto exchange development with an MVP to validate and test your idea. At this stage, you should focus on functionality over complexity, ensuring users can seamlessly list, buy, and sell crypto digital assets.

- User registration and authentication: A secure login system with two-factor authentication (2FA) and password encryption.

- Crypto wallet integration: Support for MetaMask, WalletConnect, and hardware wallets like Ledger.

- Order listing and matching: Users can post buy/sell orders with pricing, limits, and payment options.

- Escrow smart contracts: Funds are locked in a secure smart contract until the buyer confirms payment.

- Dispute management system: A mechanism for users to report fraudulent transactions and request arbitration.

- Security measures: Basic DDoS protection, API rate limiting, and fraud detection.

With these features in place, the MVP is ready for internal testing. A steady software roll-out with invite-only beta testers helps efficiently identify bugs, security vulnerabilities, and UX issues before moving forward.

Phase 2: Scaling, optimization, and advanced features (6 to 12 months)

With the MVP offering users basic yet valuable functionality, the next phase is increasing the platform’s capabilities to retain existing users and attract more. You can achieve this by improving security, supporting additional digital assets, and enhancing security controls and regulatory compliance.

Expanding blockchain and asset support

An advanced P2P crypto exchange software should be compatible with multiple blockchains beyond Ethereum and Bitcoin. At this stage, expert blockchain developers can integrate:

- Solana for high-speed transactions

- Binance Smart Chain (BSC) for low fees

- Layer 2 solutions like Polygon for scalability

- Lightning Network for fast Bitcoin transfers

Enhancing security and compliance

A growing trading volume increases the risks of fraud, scams, and data breaches. Strengthening platform security should be a top priority.

- KYC and AML compliance: Integration with third-party providers like Jumio, Onfido, or Civic ensures identity verification.

- AI-powered fraud detection: Algorithms analyze trading patterns to detect anomalies and flag suspicious behavior.

- Multi-layer security: Introducing multi-signature wallets, zero-knowledge proof authentication, and hardware security modules (HSMs).

Optimizing performance and scalability

With a growing user base, you’ll need a highly scalable infrastructure. Here is what you can improve to build it:

- Optimization of the matching engine: Such technologies as Redis and Kafka can be effective for real-time processing, ensuring near-instant crypto trading.

- Mobile app deployment: Native Android (Kotlin) and iOS (Swift) apps are developed for seamless mobile trading.

- Fiat on/off-ramp integration: Payment providers like Wyre, MoonPay, or Simplex enable users to buy/sell crypto using fiat.

At this stage, the platform is capable of handling thousands of simultaneous users, laying the foundation for full-scale expansion.

Phase 3: Enhanced compliance, liquidity, and global expansion (12+ months)

The final phase is about strengthening the P2P platform’s position in the market, ensuring compliance with financial regulations, and increasing trading volume and liquidity.

Regulatory compliance and licensing

Regulatory approval is critical for long-term success. Depending on the location, your P2P exchange may need:

- Money Services Business (MSB) License in the U.S.

- Financial Conduct Authority (FCA) Registration in the U.K.

- FINTRAC Compliance in Canada

- GDPR Compliance for user data protection in the EU

Enhancing liquidity and market growth

Liquidity is the lifeblood of any exchange. Without sufficient liquidity, users may experience slow transactions and wide spreads. Solutions include:

- Partnering with crypto liquidity providers.

- Launching market-making incentives to attract traders.

- Supporting staking and yield farming to engage DeFi users.

Scaling infrastructure for global expansion

A global P2P crypto exchange can support millions of users while maintaining low latency and high security. Possible optimizations for achieving global use include:

- Kubernetes-based microservices architecture for auto-scaling.

- Multi-region server deployments for global load balancing.

- Language localization and region-specific payment methods.

By the end of this phase, the P2P exchange isn’t just another functional solution but an industry leader, offering high security, liquidity, and a seamless user experience.

P2P crypto exchange security: Cost of failure is higher than investment in due protection

Prioritizing security is a definition of user trust and your brand reputation. This section outlines the critical security measures businesses should implement when developing a secure and trustless P2P crypto exchange.

Implement non-custodial and multi-signature wallets

Unlike centralized exchanges, where users must deposit funds into a platform-controlled wallet, P2P exchanges should be fully non-custodial. This means:

- Users retain full control over their crypto assets and the platform only facilitates transactions.

- Central how wallet doesn’t store funds, eliminating the risk of exchange-wide hacks.

- Blockchain technology directly processes transactions to increase their transparency and security.

Multi-signature escrow for secure transactions

Multi-signature wallets provide an extra layer of security for P2P trading based on escrow. They ensure that:

- The escrow service locks funds until the transaction is completed.

- Both the buyer and seller agree on the established transaction term before funds are released.

- A third party (arbitrator) can intervene in disputes if needed.

Businesses can eliminate the risks of centralized fund mismanagement by combining non-custodial wallets with multi-signature technology.

Smart contract security: Preventing tampering and vulnerabilities

Smart contracts are the basis of escrow transactions in a P2P exchange, so securing the smart contract layer is crucial. Poorly written smart contracts are easy prey for malicious attacks, leading to potential issues like:

- Reentrancy attacks. Allowing attackers to withdraw funds multiple times.

- Integer overflows/underflows. Affecting contract logic for financial gain.

- Front-running attacks. Using transaction delays to control trade execution.

Best practices for secure smart contract development

Conduct comprehensive smart contract audits

- Integrate third-party blockchain security services (e.g., CertiK, OpenZeppelin, ConsenSys Diligence).

- Perform timely verification to prove that the smart contract operates correctly

- With the help of fuzz testing, you can simulate attacks and uncover hidden vulnerabilities.

Follow secure development standards

- Use battle-tested smart contract libraries (e.g., OpenZeppelin for Ethereum).

- To prevent rapid withdrawals of funds in the event of an attack, implement time-locked transactions.

- To prevent spam and automated exploit attempts, use rate-limiting mechanisms.

Companies can prevent financial losses and tamper-proof their transactions by eliminating smart contract vulnerabilities.

Preventing fraud, fake transactions, and chargeback scams

While blockchain transactions are irreversible, fiat payments in a P2P exchange can be disputed. This creates an opportunity for malicious actors to:

- Send a fake payment confirmation and receive crypto before the transaction is verified.

- Initiate chargebacks (especially in credit card or PayPal transactions).

- Use stolen identities or payment details to commit fraud.

Anti-fraud measures for P2P exchange security

AI-based fraud detection

- Implement real-time risk analysis using AI-powered fraud detection.

- Flag suspicious trading patterns, such as rapid buy/sell cycles or high-risk fiat transactions.

Escrow-based payment confirmation

- Crypto funds are only released from escrow once the fiat payment is fully verified.

- Transactions are time-locked to prevent unauthorized release.

User reputation and trust scoring

- Assign trust scores based on user trading history and past reviews.

- Implement two-tier trading (new users must complete a certain number of successful trades before accessing high-value transactions).

By integrating automated fraud prevention tools, businesses can reduce risk exposure while maintaining a frictionless user experience.

KYC and AML compliance: Balancing security and privacy

While P2P exchanges emphasize privacy, compliance with KYC and AML regulations is often required in most regulations.

How to implement secure and privacy-focused KYC

Reputable KYC providers

- Use AI-driven identity verification solutions (e.g., Jumio, Onfido, Civic) to automate KYC checks.

- Implement liveness detection to prevent identity fraud.

Adaptive KYC models

- Offer tiered verification (e.g., low-volume traders can trade without KYC, while high-value transactions require full verification).

- Enable decentralized identity solutions (DIDs) for privacy-focused compliance.

Automated AML and risk monitoring

- Use blockchain analytics tools (e.g., Chainalysis, CipherTrace) to monitor suspicious transactions.

- Flag high-risk wallets linked to illicit activities.

Keeping privacy and compliance in balance ensures that the P2P crypto exchange remains legal and maintains user anonymity.

Infrastructure security: DDoS protection and secure APIs

There are many cyberattacks targeting P2P crypto exchanges, such as DDoS attacks, API abuse, and phishing scams.

Best practices for securing exchange infrastructure

DDoS mitigation

- Use cloud-based DDoS protection (e.g., Cloudflare, AWS Shield).

- Implement rate-limiting and CAPTCHA verification to block automated bots.

Secure API architecture

- Use OAuth 2.0 and JWT authentication to prevent unauthorized access.

- Enable role-based access controls (RBAC) to restrict API permissions.

Regular security audits and penetration testing

- Conduct bug bounty programs to identify vulnerabilities before attackers do.

- Perform penetration testing on a regular basis to simulate real-world attacks.

By strengthening the exchange’s infrastructure, businesses can ensure continuous uptime, protect against cyber threats, and maintain seamless user access.

Why choose a P2P crypto exchange development company like Riseapps?

Here’s what businesses stand to gain by working with a trusted P2P crypto exchange development partner:

Quick ROI through streamlined development

Time-to-market is a decisive factor in the success of a P2P exchange. The longer it takes to develop, test, and launch P2P software, the greater the risk of missing market opportunities and first-mover advantages. Partnering with an experienced development company helps businesses achieve:

Rapid deployment and market entry

Instead of spending years and lots of in-house team resources to develop a crypto exchange solution, an expert team can fast-track the development process, launching a fully functional and secure platform in several months.

Optimized development costs

In-house development requires significant investment in hiring blockchain developers, security specialists, and infrastructure engineers. Outsourcing to an expert P2P exchange development firm reduces overhead, ensuring a cost-effective solution with predictable ROI.

Customizable revenue models.

A well-built P2P exchange can integrate multiple monetization strategies, such as tiered transaction fees, premium memberships, advertising or sponsorship models

This approach ensures that the platform is not just a trading hub but also a sustainable revenue-generating business.

Scalable and secure architecture

Investing in a well-designed P2P crypto exchange is inherently scalable and secure, making it an excellent choice for businesses with long-term growth plans. Key advantages include:

Future-proof scalability

Scalable by design P2P solutions can handle growing user bases without compromising performance. In this way, businesses can attract more users with time, as global crypto adoption is projected to reach 900 million users in 2025 according to Statista.

Enhanced cybersecurity

P2P exchanges minimize cyberattack risks by eliminating central points of failure and using decentralized mechanisms. This is especially critical given that centralized exchanges suffered losses of over $3.8 billion in hacks in 2022 alone (as per Chainalysis report).

Long-term business growth

P2P exchanges do more than cut costs and increase security—they open new business opportunities in global markets. A strong development partnership can become your facilitator in building long-term business expansion strategies by ensuring:

Borderless trading and financial inclusion

Traditional financial systems exclude over 1.4 billion people worldwide due to a lack of banking infrastructure or restrictive regulations. A P2P exchange bridges this gap by:

- Allowing crypto-to-fiat transactions in unbanked regions.

- Enabling peer-to-peer remittances with lower fees than banks.

- Supporting multiple fiat gateways (bank transfers, mobile wallets, stablecoins).

Regulatory adaptability for global expansion

With the right development partner, businesses can quickly:

- Customize KYC requirements based on country-specific regulations.

- Integrate compliance modules to prevent legal risks.

- Offer region-specific payment methods to cater to local users.

Customizable trading features to drive adoption

Unlike centralized exchanges, P2P platforms can introduce:

- Localized trading pairs (e.g., BTC ↔ INR, USDT ↔ NGN).

- Multiple language support for broader accessibility.

- Community-driven governance models (DAO-based dispute resolution).

By enabling borderless and frictionless transactions, businesses can expand their reach, increase trading volume, and drive long-term growth.

FAQ

What are the advantages of P2P crypto exchange solutions over centralized ones?

P2P crypto exchange platforms offer advanced data privacy, lower fees, and enhanced security by eliminating intermediaries. These platforms also provide users with full control of their assets and enable borderless transactions.

How long does it take to build a P2P platform with a P2P crypto exchange software development company?

Estimated development timelines of the crypto exchange development process can range from 6 months to over a year depending on whether you choose a white-label solution or custom development.

What are the most critical security features in P2P crypto exchanges?

Essential security features include multi-signature wallets, two-factor authentication, end-to-end encryption, DDoS protection, and adherence to regulatory standards like KYC and AML.

What is a P2P crypto exchange?

A P2P (peer-to-peer) crypto exchange is a decentralized trading platform that enables direct cryptocurrency transactions between users without intermediaries. Key features include: direct user-to-user trading, escrow-protected transactions, multiple payment method support, smart contract automation.

How to start a P2P crypto exchange?

You can start a P2P crypto exchange by focusing first on essential trading features, then scaling security and compliance, and finally expanding market reach. The total development cost ranges from $100K-$400K for a fully custom solution, while white-label options could start from $50K.

Step 1: Build Foundation (3-6 months)

- Design secure architecture with frontend, backend, and blockchain integration

- Implement user authentication and wallet features

- Develop escrow smart contracts

- Initial cost: $300K-$500K

Step 2: Enhance Platform (6-12 months)

- Add Bitcoin, Ethereum, and Solana blockchain support

- Set up KYC/AML compliance systems

- Deploy security infrastructure

- Additional cost: $200K-$500K

Step 3: Launch to Market (12+ months)

- Obtain regulatory licenses

- Secure liquidity partnerships

- Scale for global users

- Investment needed: $500K+

Can I create my own crypto exchange?

You can create a crypto exchange through custom development or white-label solutions. Custom development provides full control over architecture, security, and features but requires $100K-$400K investment and 4-6 months of development. White-label solutions offer faster market entry within 4-12 weeks at $50K-$150K, with pre-built features and vendor support but limited customization and integration options.

How much do I need to start P2P?

Starting a P2P crypto exchange requires strategic investment across key areas. White-label solutions cost $50K-$100K for basic setup, while custom development ranges from $100K-$300K. Additional costs include monthly operations ($20K), marketing ($100K first 6 months), and security audits ($50K-$200K). Break-even typically occurs within 6-12 months with 1,000-2,000 active users.

How much does it cost to start a crypto exchange?

Total costs for starting a crypto exchange vary by development approach and features. Core development requires $100K-$400K, security implementation costs $40K-$100K annually, and infrastructure setup needs $50K+ yearly. Operational expenses include $20K-$50K monthly, marketing budget of $100K+, and liquidity provision of $500K-$1M. Compliance and licensing add another $100K+.

Contact Us